Written by Min-Hua Chiang.

Image credit: 2025 Taiwan Innotech Expo: Innovation Economy Pavilion by Rico Shen / Wikimedia, License: CC BY-SA 4.0.

With an estimated 7.37% economic growth rate in 2025, Taiwan is likely to be one of the world’s top performers of the year. Alongside the momentous economic growth, Taiwan’s GDP per capita is expected to reach US$38,748, up from US$34,238 in the previous year. Yet, most people in Taiwan did not feel the benefits of the thriving economy.

The official data show that Taiwan’s economic growth rate has been ahead of that of major economies worldwide in the first three quarters (Table 1). The uprising economy is expected to remain in the fourth quarter thanks to the strong global demand for chips and electronic products.

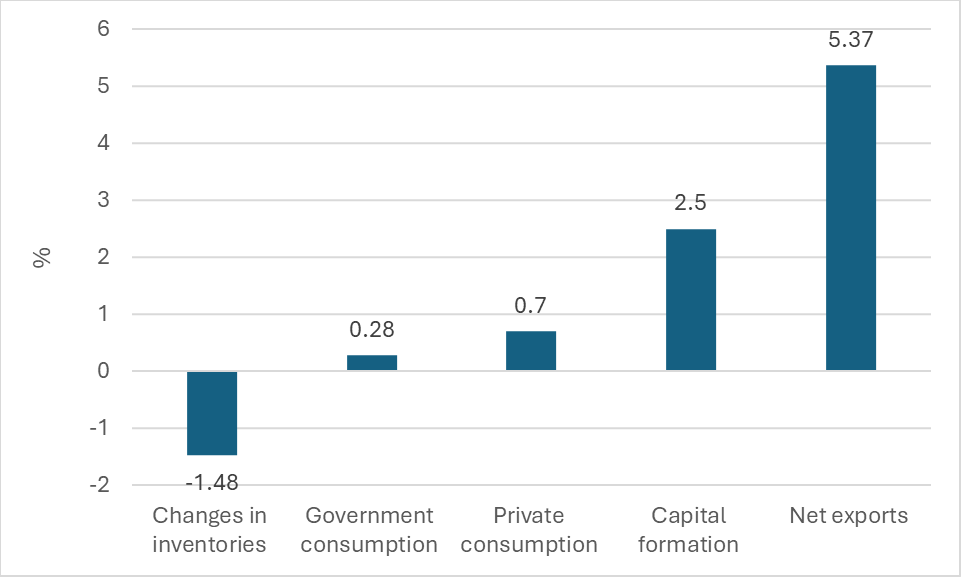

The government forecasts also show that robust net exports and capital formation are the two leading contributors to the economic expansion. Meanwhile, the private and government consumption grow relatively slowly in 2025 (Figure 1).

Table 1: Comparing Taiwan’s economic growth rate with that of major economies in the world

Year-over-year economic growth rate (%)

| Taiwan | United States | Japan | European Union | China | Hong Kong | South Korea | Singapore | |

| 2024 | 5.3 | 2.8 | -0.2 | 1.1 | 5.0 | 2.5 | 2.0 | 4.4 |

| 2025 Q1 | 5.5 | 2.0 | 1.8 | 1.7 | 5.4 | 3.0 | 0.0 | 4.1 |

| Q2 | 7.7 | 2.1 | 2.0 | 1.6 | 5.2 | 3.1 | 0.6 | 4.7 |

| Q3 | 8.2 | n/a | 1.1 | 1.6 | 4.8 | 3.8 | 1.7 | 4.2 |

Figure 1 Contribution to Taiwan’s economic growth by expenditure in 2025

The growing exports are mainly attributed to Taiwanese firms’ expanding market shares in the United States. According to Taiwan’s Ministry of Finance, the United States has become Taiwan’s largest export destination, accounting for 31% of Taiwan’s total exports, followed by China and Hong Kong’s 27%, and 10 countries in the Association of Southeast Asian Nations’ (ASEAN) 19% in 2025.

The increasing exports to America have been driven by the information, communication, and audio-video products, which took 77% of Taiwan’s total exports to the country in 2025. In comparison, Taiwan’s declining exports to China and Hong Kong are due to the falling exports of electronic components. The US’s higher tariffs on Chinese goods shifted the export platform of the final consumption goods from the mainland to the island. Meanwhile, the US export control measures restrained Taiwan’s exports of advanced chips (which are in the category of electronic components) to China.

Overall, the information and communication technology (ICT) goods, which contain the electronic components and information, communication, and audio-video products, accounted for 74% of Taiwan’s total exports in 2025, from 65% in the previous year.

The import growth is mostly owing to the greater purchase of semiconductor equipment and integrated circuits from overseas, accounting for 35% of Taiwan’s total imports in 2025. The much larger export amount than import amount contributed to the quick growth of trade surplus, surging significantly from US$81 billion in 2024 to US$157 billion in 2025.

The capital formation increased as a result of the rapid development of artificial intelligence (AI) worldwide, which boosted Taiwanese semiconductor firms to purchase related equipment for making chips for their clients in the AI industry. The semiconductor industry has been the main contributor to Taiwan’s capital formation over the past decade; notably, TSMC’s capital expenditure made the most important contribution.

Nevertheless, the exports in other industries did not increase as much as the ICT industries. Indeed, some of them have been shrinking, especially the exports of basic metals, plastics, textiles, and transportation equipment, which have consistently declined over the last three years, according to official data. Given Taiwan’s small market size, the weak exports signified their feeble business in recent years.

In contrast, the ICT industry’s outstanding export performance allowed it to gain a much larger business revenue. For instance, the ICT industry, including electronic component manufacturing, computers, electronic products, and optical instrument manufacturing, accounted for almost 40% of all the industries’ revenue in 2023. Over 80% of its revenue was generated by exports, while 20% of its revenue came from domestic sales, according to the data from the Ministry of Economic Affairs.

The substantial chunk of business revenue earned by the ICT industry alone poses a challenge to Taiwan’s economic equality. The more sizable business revenue allowed ICT firms to offer employees better remuneration. However, companies in other industries, which hire a larger number of people, were not able to do the same due to the relatively smaller revenue. For instance, people working in the ICT industry accounted for less than 11% of Taiwan’s total employment. Nonetheless, their average monthly gross income is 1.6 times higher than the average monthly gross income of all the industries combined, according to the official data.

The growing income inequality in Taiwan is not news. It has developed gradually since the 2000s, when a lot of manufacturing jobs were relocated overseas. Although the official data reckons Taiwan’s gini coefficient (0.341) is still better than many countries in the world, it was much worse than during Taiwan’s industrialisation period in the 1970s and 1980s. The World Inequality Report reckons that in 2024, the top 10% earners in Taiwan received 48% of total income, whereas the bottom 50% only received 12%.

The higher inflation rate in recent years has worsened the livelihood of the majority of people whose income was relatively low. The food price in 2025 (Jan-Nov) went up by 3.4%, higher than the United States’ 2.9%, the Eurozone’s 2.7%, South Korea’s 3.1% and Singapore’s 1.5%.

Apart from the elevated inflation, the skyrocketing housing prices are another factor that restrains people’s propensity to consume, thus resulting in weak private consumption. The policy to curb the housing price surge has not shown a positive impact yet. Taiwan’s Central Bank’s report reckons that the household debt to GDP ratio is nearly 93% in 2024, much higher than China (61.4%), Japan (65.1%), and the United States (69.4%). The same report also shows that over 61% of household debt is from purchasing real estate.

The ageing population indicates that private consumption could decrease even more in the future. With more than 20% of the population aged 65 years old and above in 2025, Taiwan has already entered into a super-aged society. The total population is estimated to be reduced by nearly 3 million people in two decades, from now to 2045, according to the National Development Council.

The relatively low government debt-to-GDP ratio means that Taiwan has sufficient financial resources to energise private consumption, equalise the income distribution, and improve the social welfare through extra government spending. In addition, the government should incentivise other industries to innovate and expand their global market shares. Encouraging the adoption of AI software and the use of robots might be a way to enhance other industries’ productivity and increase their international competitiveness.

Taiwan’s manufacturing prowess in the ICT industry has enabled the island to connect with the world economy more extensively despite its economic rupture with China in recent years. In particular, Taiwan’s semiconductor economy will continue to benefit from the worldwide AI boom in the foreseeable future. For instance, the top AI company, Nvidia, has relied fully on TSMC for making chips. Other tech giants such as Apple, Microsoft, Amazon, AMD, and Alphabet have depended on chips made by TSMC as well.

However, unbalanced industrial development has already resulted in unequal economic benefit distribution. Taiwan especially needs to stay united in the face of China’s attempts to divide different groups in society. The ICT industry’s development helped Taiwan to grab an important position in the global supply chain network. It is essential to uplift other industries to the world stage to sustain a healthy and diversified economic development in the long run.

Min-Hua Chiang is a non-resident fellow at the Taiwan Research Hub, University of Nottingham.

This article was published as part of a special issue on ‘Review Taiwan 2025: Challenges, Continuities, and Change.’