written by Min-Hua Chiang

Image Credit CPU by Mirko Waltermann licence CC BY 2.0

While many economies worldwide have been slammed by the prolonged pandemic crisis, the latest official figure showed that Taiwan’s economy has remained relatively strong. Taiwan’s solid economic growth (3% in 2020 and 6.1% in 2021) is not only above the global average but also ahead of other export-oriented countries. Apart from its effective countermeasures against Covid-19, Taiwan’s manufacturing prowess and production flexibility explain its resilience to the global economic slump. Moreover, Taiwan’s irresponsible role in the global supply chain network and the persistently robust global demand for Information and Communication Technology (ICT) products suggest that the island’s economy is likely to continue to gain momentum in the foreseeable future.

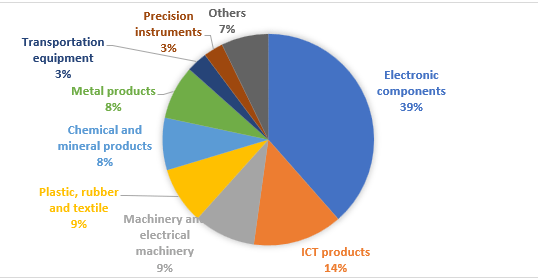

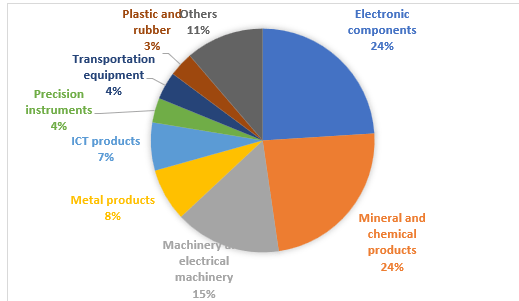

Taiwan’s Highly Specialized ICT Industry

In the last two decades, Taiwan’s manufacturing economy has been driven by its highly developed ICT industry. The importance of the ICT industry in Taiwan’s total manufacturing production value has increased from 36% in 2000 to 44% in 2020. Electronic components and ICT products accounted for 53% of its total exports and 31% of its total imports in 2021 (Figure 1 and 2). Thanks to the gradual recovery of the global economy, Taiwan’s exports of mineral products, plastics and rubber and metal have also registered significant growth in the same year. Taiwan’s strong exports promoted its imports of crude oil, raw material and semi-industrial goods for production at home. The development of imports in 2021 is particularly true for crude oil.

During the global pandemic crisis, Taiwan’s ICT-dominated economy has benefitted from the strong demand for long-distance communication equipment. A highly competitive semiconductor industry that supplies the most advanced key components for making ICT products is particularly important in explaining its outstanding economic performance. The semiconductor chips are also widely used in automobiles, artificial intelligence, military and other high technology products. The small island with only 23 million population took nearly two-thirds of foundry sales in the world. Taiwan Semiconductor Manufacturing Company (TSMC) alone accounted for over 50% of global foundry sales in 2020.

Figure 1 Taiwan’s export structure in 2021

Figure 2 Taiwan’s import structure in 2021

Explaining Taiwan’s manufacturing strength in the ICT industry

Taiwan has accumulated manufacturing capabilities via OEM arrangements with foreign MNCs since the 1970s. By cooperating with their subsidiaries on the island, these MNCs acquired the essential components at the lowest cost. Relocating manufacturing production to China has expanded Taiwanese firms’ scale of production at lower costs. Mass production at low cost also enabled the MNCs’ brands to remain competitive in the global market. Foreign MNCs’ close production relations with Taiwan, through production in China, is especially clear in the ICT industry.

An important reason for the steadily solid cross-strait production network in the ICT industry is the reluctance of Apple (Taiwan ICT manufacturers’ largest client) to withdraw most of the production lines out of China. Apple’s direct and indirect workforce in China was over 100 million. Such massive employment of workers allowed Apple to hold strong bargaining power with the Chinese government for better access to China’s consumption market. For China, producing Apple’s devices helped optimize employment numbers and offer a source to advance its technology. Taiwanese subcontractors expanded their business by counting on the Chinese government to access the vast flexible labour force and acquire land to construct factories.

Several official statistics showed that Taiwan’s massive investment in China and other developing countries did not lead to manufacturing hollowing out. Instead, relocation of labour-intensive manufacturing production to overseas countries allowed domestic industries to upgrade. As a result, the manufacturing production value as a percentage of Taiwan’s GDP grew from 25% in 2000 to 32% in 2020. The expansion of manufacturing weight in the economy is attributed to the growing exports with high technology and capital intensity. The degree of capital and technology intensity in Taiwan’s exports increased considerably over the last few decades. In comparison, the degree of capital and technology intensity in Taiwan’s import structure declined. Taiwan’s industrial upgrading is especially clear in the ICT industry, which is evidenced by the greater improvement in its value-added production.

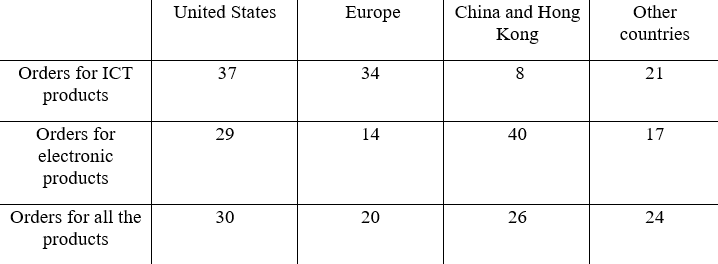

The huge demand for the final consumption products from the United States and Europe ensured the smooth operation of the production network across the Taiwan Strait. ICT and electronic products are Taiwan’s main sources of orders, accounting for nearly 60% of its total orders in 2021 (Jan-Nov). The United States and Europe are the two major sources of orders of ICT products (71% in total). In contrast, China and Hong Kong only accounted for 8%, indicating America and Europe are the main sources of demand for the final ICT products. However, the large demand for final ICT products from the United States and Europe is not clear in Taiwan’s exports since most of them are exported from China. In comparison, China and Hong Kong took a lion share in Taiwan’s orders of electronic products, which is a clear sign of demand for Taiwan’s key components for manufacturing into final goods (Table 1).

Table 1 Main sources of Taiwan’s orders for exports in 2021 (Jan-Nov)

As% of Taiwan’s total orders for exports

Taiwan’s ICT industry in perspective

China was considered a potentially important competitor to Taiwan’s ICT firms a few years ago. However, China’s effort to reduce its reliance on importing key components was unsuccessful. In July 2021, Tsinghua Unigroup, a state-backed semiconductor manufacturer, filed a bankruptcy request. Chinese chip industry only took 7.6% of total global semiconductor sales. Its equipment and materials for production are still limited to older technologies. The American government has been encouraging manufacturing production at home to reduce imports of key components from overseas. Nevertheless, the high labour cost and lack of qualified workers in the semiconductor industry will make it difficult to reduce its reliance on Taiwan. The greater US-China competition in the high technology industry is only likely to increase the superpowers’ dependence on Taiwan’s semiconductor industry.

Taiwan’s over-reliance on the ICT industry was considered a risk for the economy. However. It is not easy for Taiwan to achieve industrial diversification due to the limited FTA network. The fact that Taiwan only has privileges exporting ICT products under WTO’s Information Technology Agreement (ITA) means that Taiwan’s other industrial goods are biased in international trade. The ICT industry has become the only industry that Taiwan has a relatively more comparative advantage to develop. The highly developed ICT industry boosted Taiwan’s economic growth, but it has enlarged the income gap at the same time. The workers’ monthly salary in computers, electronic components and optical instruments is nearly three times greater than workers in low value-added services, such as in food and accommodation. In addition, when labour-intensive factories relocated to China, the unskilled labourers lost their jobs. The official statistics showed that most people who suffered from unemployment in the last two decades were those with an inferior level of education. The unemployment rate among people with education above college increased relatively less.

Taiwanese workers in the ICT industry did not benefit much from the booming ICT industry in the last two decades. A large portion of profit earned by the manufacturing firms was devoted to investing in new and more advanced capital equipment. As a result, the share of “employees’ remuneration” in national domestic factor income increased slightly from 11% in 2000 to 13% in 2020 in the ICT industry. In comparison, the “capital expenditure” percentage grew more clearly from 8% to 14% during the same period. The relatively insignificant changes of employees’ remuneration” can also be observed in other industries. In other words, Taiwan’s industrial upgrading has been relying much on its heavy investment in expansive capital equipment.

The cross-strait production network in the ICT industry is likely to remain resilient as Apple continues to produce its products in China. Meanwhile, Taiwanese firms are shifting production to Taiwan and other developing countries to better cope with the uncertain geopolitical situation in the future. In recent years, the growing investment repatriation indicated that the investors are confident about Taiwan’s future economy. Apart from the ICT industry, the Taiwanese government also plans to foster cloud computing, high-end production (hardware) and R&D in software technology (e.g. IoT, big data, 5G) through investment repatriation. In addition to developing physical infrastructure and energy for the potential expansion of manufacturing production at home, the investment in human resources to ensure Taiwan’s continuous supply of highly educated and well-trained workers are also imperative for sustainable economic development.

Min Hua Chiang is an author and research fellow at the East Asian Institute, National University of Singapore.

This article was published as part of a special issue titled ‘Taiwan 2022: Reflections, Predictions and Trends”.